Eric Guigné is the President and Founder of POLARYS, a Digital Services Company specialized in DATA working with more than 300 companies among which, the Investment Funds. Entrepreneur but also Business Angel, he answers our questions during the 5th edition of the START-UP GOLF CHALLENGE in Paris

1/ Data for Investment Funds, is it a topic?

Indeed, the stake in private equity is to be able to recover a maximum of Data, and to analyze a maximum of information to make the best decisions.

The best investment decisions, the best sales decisions, the best decisions for managing the companies they buy, for merging them or making them grow

POLARYS’ business is to have consultants, experts on all these DATA issues.

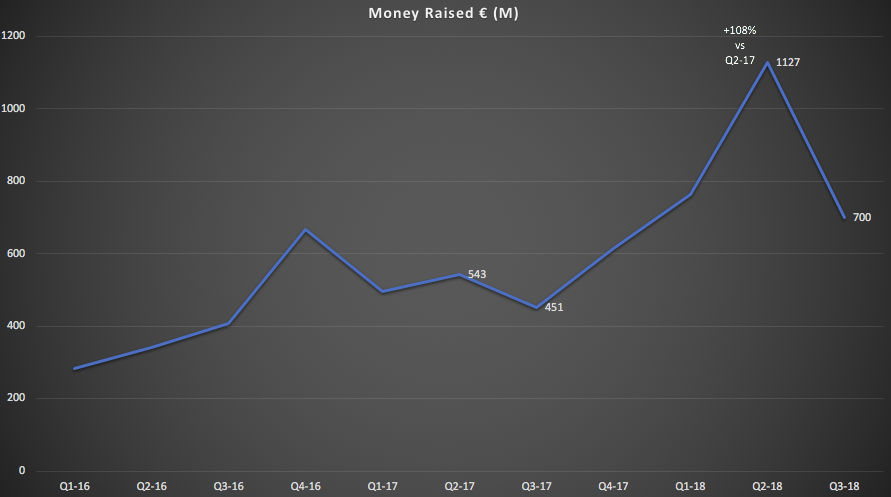

Data recovery, data analysis in order to implement data architectures for business decision makers in the private equity business. There is a lot of information that the Funds have on their own performance. But there is even more information that can be found outside. The open data to the paid data through Data Providers.

There is a gold mine and it is a very important issue to find the best opportunities for growth.

Suivre ses investissements grâce à la data

2/ How POLARYS help Investment Funds

Polarys’ job is to provide consulting and integration services for data and decision making.

So consulting means analyzing our customers’ needs and recommending the best solutions, X, Y or Z, because there are many technological solutions on the market and it is difficult for our customers to see clearly.

POLARYS have experts who are able to do this independently. We are not a re-seller, we are not a player in a single technological solution. We assess all the possible solutions on the market for the mid-market, for very large international funds, for funds that do Mezzanine, for funds that do Fund of Funds or LBO.

Contact us for Fundraising? Apply on MY PITCH IS GOOD , we will get back to you and help you in your fundraising. MY PITCH IS GOOD makes the introduction to our Network of Investors.

All of these are relatively different. The needs are different, the fundraising processes are different. The due diligence processes are different and therefore there are different tool needs.

So our first activity is what we call “Think”. An upstream consulting to recommend the right architectures.

We provide support. We don’t just say “you should do this” but we help concretely with commitments on results.

Setting up these information systems until they have platforms that allow them to better see their investors, their clients, their portfolio, the performance of their entire ecosystem and also to compare themselves and do benchmarking, which is also very important.

3/ Who are the clients of POLARYS

We are talking about thirty clients who are divided between small management companies that manage 2 or 3 funds.

Generally you need to have at least 2 or 3 funds for it to become a little complicated and for it to be necessary to set up an information system, but our smallest clients manage less than a billion. they manage a few funds of a few hundred million.

But our smallest clients manage, I think, less than a billion, manage a few funds at a few hundred million. Up to very large funds such as ARDIAN or ADIA in the Emirates. These large funds which are obviously record-breaking funds that we know are the largest in Europe or the largest sovereign wealth funds in the world.

They have relatively different issues. It’s the same thing but it’s 10 times or 100 times much more.

The tools, methods and teams use different technologies. But we are fortunate to be able to serve this whole spectrum of clients. they sometimes only do fund of funds, sometimes only direct, sometimes Mezzanine, sometimes Real Estate, who do different asset classes.

4/ What do you think about MY PITCH IS GOOD ?

It’s a great platform that we are very happy to be associated with.

We like these meetings between project holders, inventors, start-ups and then obviously there is a need to finance them, and it’s really a great place to make them meet so bravo for this great initiative too.

POLARYS is a partner of the 5th edition of Paris of the START-UP GOLF CHALLENGE at golf de l’isle Adam, the 17th September 2021.

START-UP GOLF CHALLENGE ,& MY PITCH IS GOOD

Check out the Interview of Eric Guigné on our page Youtube MY PITCH IS GOOD

Interview made by Fabrice Clément –> #mytwitter / #mylinkedin